:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/thenational/QHTDGGX7GS2ZNT7UW4G6CD34CI.jpg)

Lebanon continues to endure runaway inflation as politicians jostle to form a new government more than a month after parliamentary elections, delaying the enactment of reforms that can unlock $3 billion from the International Monetary Fund to resuscitate its economy.

Inflation in the country, which faces its worst economic crisis since its independence in 1943, rose to 211 per cent last month from the same period a year earlier.

This is the 23rd consecutive triple-digit increase of the Central Administration of Statistics‘ Consumer Price Index since July 2020. The index increased 7.85 per cent from April 2022.

“The inability of the authorities to monitor and contain retail prices … as well as the fluctuation of the Lebanese pound’s exchange rate on the parallel market and the gradual lifting of subsidies on hydrocarbons, have encouraged opportunistic wholesalers and retailers to raise the prices of consumer goods disproportionately,” Byblos Bank said in a note on Tuesday.

The smuggling of imported goods has also led to supply shortages locally while raising their prices, the lender said. The emergence of a black market for the trading of petrol has also driven up inflation.

Transport costs increased 515 per cent in May 2022, compared with the same month last year, followed by the health segment, which surged 468 per cent.

Water, electricity, gas and other fuels soared 445 per cent while food and non-alcoholic beverages rose 364 per cent.

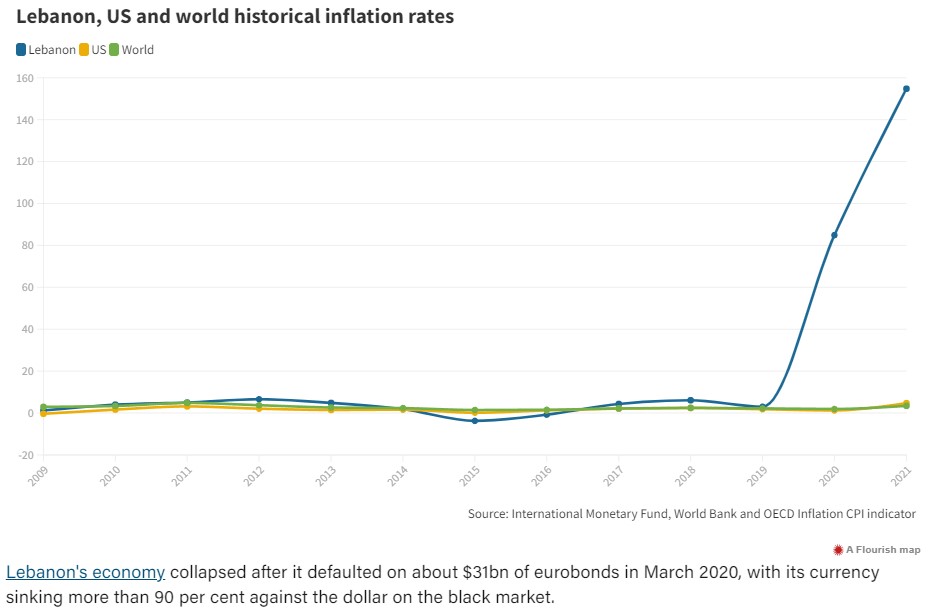

Inflation in the country soared to about 155 per cent in 2021. However, it remains far from its peak of 741 per cent towards the end of 1987 — during the country’s civil war from 1975 to 1990.

Lebanon’s economy collapsed after it defaulted on about $31bn of eurobonds in March 2020, with its currency sinking more than 90 per cent against the dollar on the black market.

Public debt, already a major overhang, continued to rise, reaching $100bn, or about 212 per cent of gross domestic product, in 2021.

That ranks Lebanon as the country with the fourth-highest debt-to-GDP ratio in the world, surpassed only by Japan, Sudan and Greece, according to the World Bank.

A political vacuum and failure to form a new government is expected to exacerbate the country’s economic crisis.

Lebanon’s political elite also need to agree on a new president by October 31, when Michel Aoun’s six-year term expires.

The president has to be a Maronite Christian, according to the country’s power-sharing structure. The president approves all legislation and serves as commander in chief of the Lebanese army.

Political wrangling left Lebanon without a president for two and a half years until Mr Aoun’s election by the 128-seat Parliament in 2016. His predecessor Michael Sleiman was elected in 2008 after the position remained vacant for 18 months.

Donor countries and international organisations have been reluctant to provide any funding to the country until it begins to put in place the necessary reforms.

The IMF’s permanent representative in Lebanon, Frederico Lima, met caretaker Finance Minister Youssef Khalil, a former central bank official, this week, as well as other politicians in the country.

Securing IMF funding will help to unlock a further $11bn of assistance that was pledged at a Paris donor conference in 2018.

Lebanese authorities must enact a list of reforms before the fund’s board approves the four-year $3bn credit line.

Those measures include the government’s approval of a bank restructuring strategy, bank secrecy law reforms and the endorsement of a medium-term fiscal and debt restructuring strategy.

Once the IMF programme is in place, Lebanon’s government will need to make other changes that include a single exchange rate and capital controls, as well as reform state-owned enterprises and strengthen governance and fiscal reforms.

The country’s economy contracted about 58 per cent between 2019 and 2021, with GDP falling to $21.8bn in 2021, from about $52bn in 2019, according to the World Bank.

That is the largest contraction on a list of 193 countries.

Robert Oppenheimer, father of the atomic bomb, wrongly stripped of security clearance, US says

The Biden administration has reversed a decades-old decision to revoke the security clearance of Robert Oppenheimer, the physicist called the father of the atomic bomb for his leading role in World War II’s Manhattan Project. U.S. Energy Secretary Jennifer Granholm...

Powerball: See the winning numbers in Saturday’s $149 million drawing

It’s time to grab your tickets and check to see if you’re a big winner! The Powerball lottery jackpot continues to rise after one lucky winner in Kansas won $93 million in the November 19 drawing. Is this your lucky night? Here are Saturday’s winning lottery numbers:...

US charges Sam Bankman-Fried with defrauding investors

The US Securities and Exchange Commission (SEC) has charged Sam Bankman-Fried with "orchestrating a scheme to defraud investors" in the failed cryptocurrency exchange FTX. The former FTX boss was arrested on Monday. Mr Bankman-Fried built a "house of cards on a...

Medina County Scam Squad coming to residents’ rescue

Both local and widespread scams have been claiming victims for years, continuing to increase and change as technology and other factors evolve. To combat this, the Medina County Office of Older Adults and the Medina County Prosecutor’s Office have worked together to...

Ohio man who hid camera in bathroom to record children sentenced to 20 years in prison

A federal judge sentenced a man to 20 years in prison for creating child pornography, including using a hidden camera in a bathroom to secretly record children. Timothy Wright, 50, of Dublin, Ohio, also will spend 10 years on supervised released once he completes his...

Submit your event

We will be happy to share your events. Please email us the details and pictures at publish@profilenewsohio.com

Address

P.O. Box: 311001 Independance, Ohio, 44131

Call Us

+1 (216) 269 3272

Email Us

Publish@profilenewsohio.com