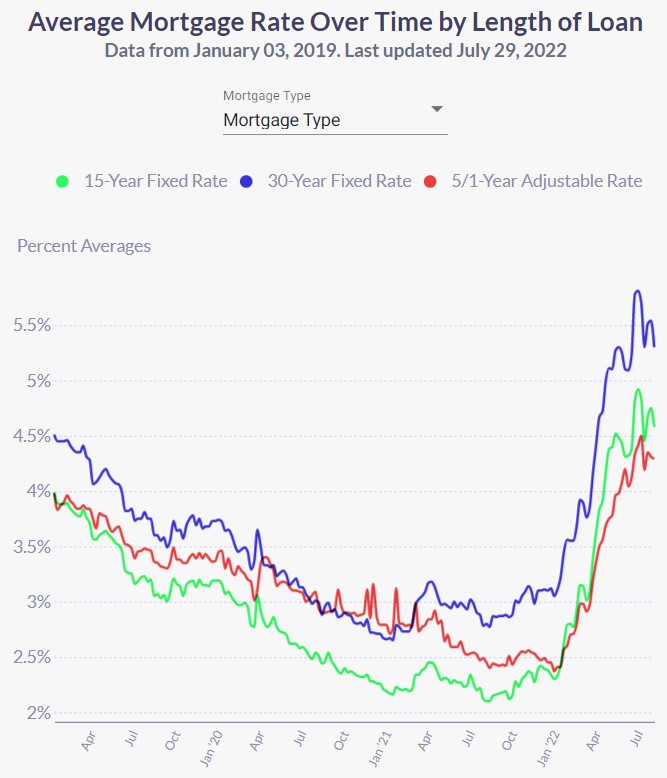

Homebuyers are getting some relief. The average rate on a 30-year fixed rate mortgage nationally is below 5% for the first time since April.

The average rate on a 30-year fixed mortgage was 4.99% Thursday, down from 5.3% a week ago, according to Freddie Mac, a government-sponsored home-loan agency. Rates on a 15-year fixed mortgage were 4.26%, down from 4.58% last week.

Average rates on a 30-year mortgage haven’t been below 5% since April 7, according to Freddie Mac data. Rates are dropping despite the Federal Reserve raising interest rates last week.

“Mortgage rates remained volatile due to the tug of war between inflationary pressures and a clear slowdown in economic growth,” said Sam Khater, Freddie Mac’s Chief Economist. “The high uncertainty surrounding inflation and other factors will likely cause rates to remain variable, especially as the Federal Reserve attempts to navigate the current economic environment.”

The difference can save homebuyers thousands of dollars over the life of a loan.

On a fixed rate 30-year loan at 4.99%, a buyer would pay $804 a month in principal and interest on a $150,000 loan. Interest would add up to $140,000 over 30 years.

On a fixed rate 30-year loan at 5.3%, a buyer would pay $833 a month in principal and interest on a $150,000 loan, with interest just shy of $150,000 over 30 years.

The National Association of Realtors said existing home sales were down in June, according to data released July 18. Sales were down 5.4% compared to May and down 14.2% compared to June 2021. July data is not yet available.

Najib Mikati promises justice for Irish UN peacekeeper killed in Lebanon

Lebanon is determined to uncover the circumstances that led to the killing of an Irish UN peacekeeper, caretaker prime minister Najib Mikati said during a visit to the headquarters of the UN Interim Force in Lebanon (Unifil) on Friday. Private Sean Rooney, 23, was...

US appeals court says lawsuit against Lebanese bank can proceed

A US court of appeals has ruled that cases against Lebanese commercial banks can be tried outside Lebanon, paving the way for more cases by depositors seeking to unlock their frozen funds. The court decision, issued on Thursday in a case brought by Lebanese depositors...

Submit your event

We will be happy to share your events. Please email us the details and pictures at publish@profilenewsohio.com

Address

P.O. Box: 311001 Independance, Ohio, 44131

Call Us

+1 (216) 269 3272

Email Us

Publish@profilenewsohio.com