IMAGE SOURCE,AFP

IMAGE SOURCE,AFPRussia has said it may close its main gas pipeline to Germany if the West goes ahead with a ban on Russian oil.

Deputy Prime Minister Alexander Novak said a “rejection of Russian oil would lead to catastrophic consequences for the global market”, causing prices to more than double to $300 a barrel.

The US has been exploring a potential ban with allies as a way of punishing Russia for its invasion of Ukraine.

But Germany and the Netherlands rejected the plan on Monday.

The EU gets about 40% of its gas and 30% of its oil from Russia, and has no easy substitutes if supplies are disrupted.

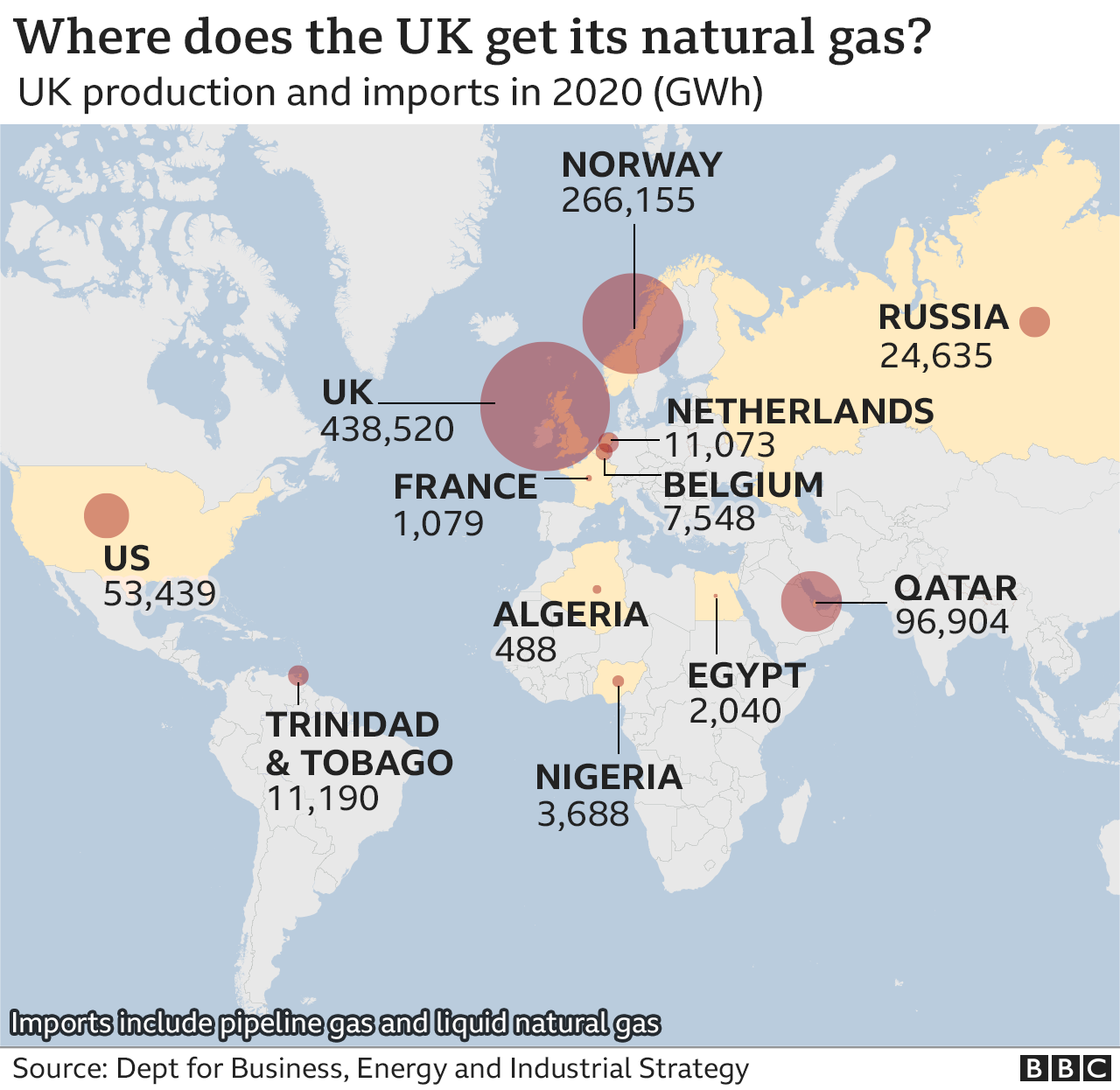

While the UK would not be directly impacted by supply disruption, as it imports less than 5% of its gas from Russia, it would be affected by prices rising in the global markets as demand in Europe increases.

Iain Conn, the former boss of British Gas owner Centrica, said natural gas was “less freely” traded compared to oil, and it would be “much more difficult” to replace Russian gas if supplies are affected as it is transported through fixed pipelines from country to country.

In an address on Russian state television, Mr Novak said it would be “impossible to quickly find a replacement for Russian oil on the European market”.

“It will take years, and it will still be much more expensive for European consumers. Ultimately, they will be hurt the worst by this outcome,” he said.

Pointing to Germany’s decision last month to freeze certification of Nord Stream 2, a new gas pipeline connecting the two countries, he added that an oil embargo could prompt retaliation.

“We have every right to take a matching decision and impose an embargo on gas pumping through the [existing] Nord Stream 1 gas pipeline,” he said.

Russia is the world’s second largest gas producer and third largest oil exporter, and any move to sanction its energy industry would badly damage its own economy.

Nathan Piper, head of oil and gas research at Investec, said although sanctioning Russia’s oil and gas exports was attractive, “practically it is challenging”.

He said both the global oil and gas markets were tight ahead of the war in Ukraine “with limited spare capacity to replace any disrupted Russian volumes”.

“The question is now whether US and European leaders are prepared to endure high oil and gas prices to add energy exports to the sanctions list,” he told the BBC.

“The threat of this action is almost the worst of both worlds, forcing prices up but doing nothing to limit Russian volumes or the revenues flowing to Moscow.”

Mr Piper warned that rising prices in Brent crude oil – the global oil benchmark – reflected the risk that if Russian oil was removed from the market in the long term, global spare capacity could be wiped out “in a stroke”.

The energy markets have been supremely volatile over the past week, and understandably so. There are genuine fears that supplies of oil and gas from Russia could be cut off or disrupted.

Yet the response to Russia’s suggestion it could close a major pipeline, depriving northern Europe of a large chunk of its gas supplies, has been pretty muted so far.

There are a couple of reasons for this. Firstly, Russia is threatening a tit-for-tat embargo – cutting off its gas exports if the West goes ahead with a ban on Russian oil.

But despite pressure from the US, such a ban is unlikely. European leaders have already poured cold water on the idea – so Russia’s counter-threat carries relatively little weight.

And then there’s the fact that Russia is still making huge sums from sales of oil and gas to Europe every day, helping to fund its war.

Moscow has everything to gain from exploiting traders’ nerves to push up energy prices; but a great deal to lose if it were to carry out its threat.

Ukraine has implored the West to adopt an oil and gas ban, but there are concerns it would send prices soaring. Investor fears of an embargo drove Brent crude oil to $139 (£106) a barrel at one point on Monday – its highest level for almost 14 years.

Rises in Brent crude were muted on Tuesday, with the price of a barrel 3% higher at $121.

Meanwhile, wholesale gas prices rose to 565p per therm after starting the day at 501p

UK stock markets rose slightly in early trading after a volatile Monday caused by the US’s discussions over a potential Russian oil and gas ban.

Early on Tuesday, nickel prices on the London Metal Exchange more than doubled to rise above the $100,000-a-tonne level for the first time, before trading in the metal was suspended.

Russia supplies the world with about 10% of its nickel needs, mainly for use in stainless steel and electric vehicle batteries.

IMAGE SOURCE,GETTY IMAGES

IMAGE SOURCE,GETTY IMAGESQuoting unnamed sources, Reuters news agency reported that the US might be willing to move ahead with an embargo without its allies, although it only gets about 3% of its oil from Russia.

However, German Chancellor Olaf Scholz has dismissed the idea of a wider ban, saying Europe had “deliberately exempted” Russian energy from sanctions because its supply could not be secured “any other way” at the moment.

European powers have, however, committed to move away from Russian hydrocarbons over time, while some Western companies have boycotted Russian shipments or pledged to sell their stakes in Russian energy companies.

Mr Novak said that Russian companies were already feeling the pressure of US and European moves to lower the dependence on Russian energy, despite fulfilling all its contractual obligations to deliver oil and gas to Europe.

“We are concerned by the discussion and statements we are seeing regarding a possible embargo on Russian oil and petrochemicals, on phasing them out,” he said.

US charges Sam Bankman-Fried with defrauding investors

The US Securities and Exchange Commission (SEC) has charged Sam Bankman-Fried with "orchestrating a scheme to defraud investors" in the failed cryptocurrency exchange FTX. The former FTX boss was arrested on Monday. Mr Bankman-Fried built a "house of cards on a...

Medina County Scam Squad coming to residents’ rescue

Both local and widespread scams have been claiming victims for years, continuing to increase and change as technology and other factors evolve. To combat this, the Medina County Office of Older Adults and the Medina County Prosecutor’s Office have worked together to...

Ohio man who hid camera in bathroom to record children sentenced to 20 years in prison

A federal judge sentenced a man to 20 years in prison for creating child pornography, including using a hidden camera in a bathroom to secretly record children. Timothy Wright, 50, of Dublin, Ohio, also will spend 10 years on supervised released once he completes his...

Powerball winning numbers for Monday, Dec. 12, 2022; jackpot $124 million

Winning numbers were selected in the Monday, Dec. 12, 2022, Powerball drawing, with the jackpot at an estimated $124 million. The winning numbers are 16-31-50-55-61 Powerball 9 Power Play 4. The Classic Lotto numbers are 1-3-4-16-17-47 Kicker 206288. The jackpot...

Northeast Ohio Monday weather forecast: Rain and snow showers possible

Chilly weather kicks off the work week in Northeast Ohio, with chances of both snow and rain showers on Monday. The National Weather Service says the best chances for snow showers are before 11 a.m., with temperatures in the mid-30s. It will be cloudy throughout the...

Mega Millions jackpot is $400 million; Sunday’s Ohio Lottery results

There was no winner in the Mega Millions drawing for Friday, Dec. 9, 2022, allowing the jackpot to increase to $400 million. Friday’s numbers are 8-19-53-61-69 Megaball 19 Megaplier 4x. The next drawing is Tuesday, Dec. 13. The Saturday, Dec. 10 Powerball drawing also...

COVID-19 hospitalizations, deaths increase among older adults

Coronavirus-related hospital admissions are climbing again in the United States, with older adults a growing share of U.S. deaths and less than half of nursing home residents up to date on COVID-19 vaccinations. These alarming signs portend a difficult winter for...

Submit your event

We will be happy to share your events. Please email us the details and pictures at publish@profilenewsohio.com

Address

P.O. Box: 311001 Independance, Ohio, 44131

Call Us

+1 (216) 269 3272

Email Us

Publish@profilenewsohio.com